We're excited to announce that we’re launching three new Generate KiwiSaver Scheme Funds and two new Generate Managed Funds!

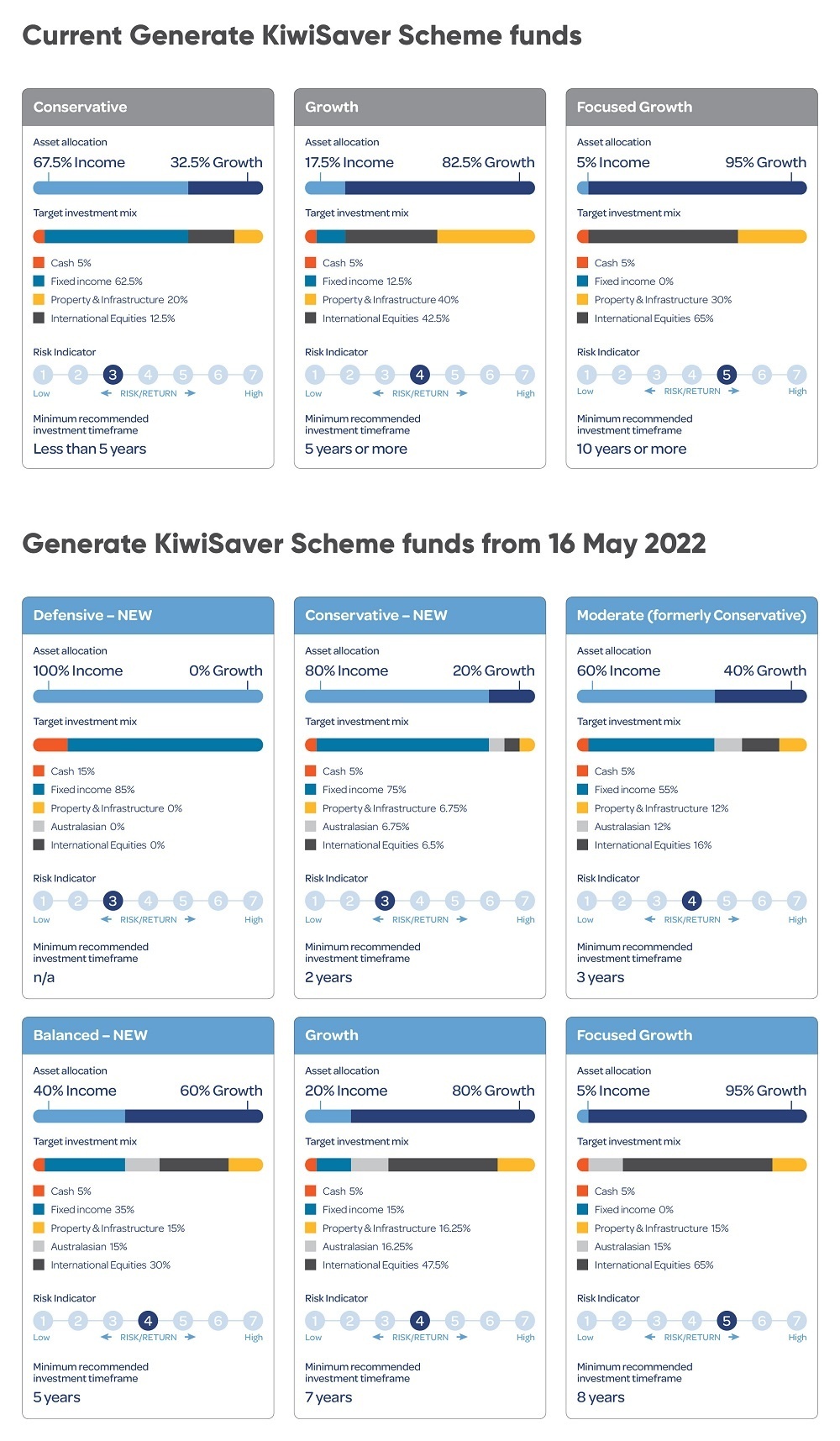

From the 16th of May 2022, Generate will offer the following funds:

- Generate KiwiSaver Focused Growth Fund

- Generate KiwiSaver Growth Fund

- Generate KiwiSaver Balanced Fund - NEW

- Generate KiwiSaver Moderate Fund - Renamed fund, formerly Conservative*

- Generate KiwiSaver Conservative Fund* - NEW

- Generate KiwiSaver Defensive Fund - NEW

- Generate Conservative Managed Fund - NEW

- Generate Balanced Managed Fund - NEW

- Generate Focused Growth Managed Fund

We’re also making some changes to the way we invest within our Conservative and Growth Funds by changing their ‘asset allocation’ and we’ll be changing our investment strategies for our Stepping Stones options.

As set out in our Product Disclosure Statement and in our Statement of Investment Policy and Objectives, we may review and change the asset allocations in our funds from time to time. As part of our extended fund range offering, we will be changing the target asset allocations within our existing funds to accommodate the new funds.

And the best part is, as well as offering a wider range of funds, we’re lowering the fees on our funds.

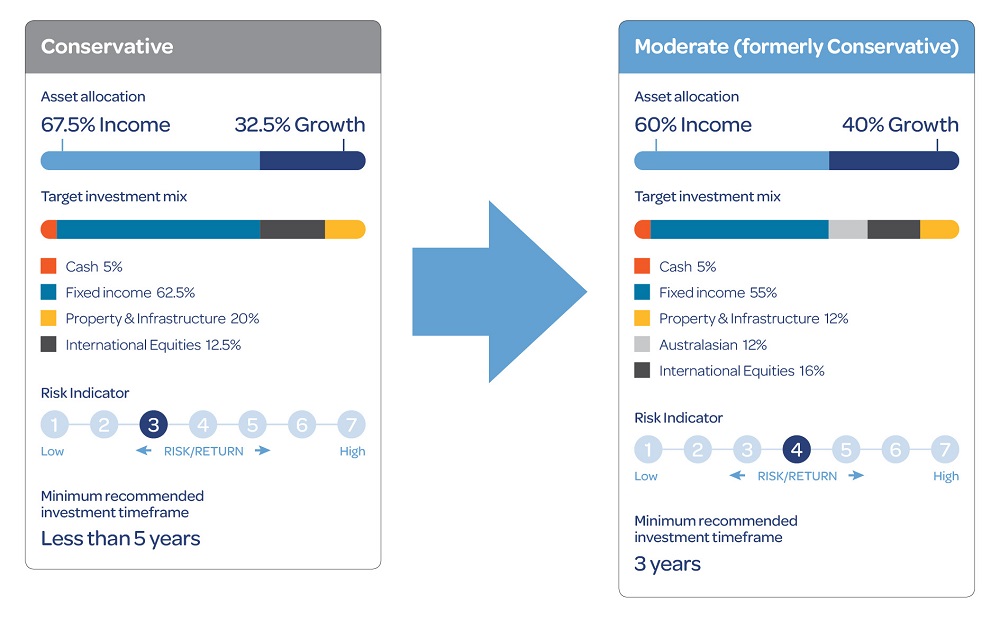

*IMPORTANT NOTE: Our current Conservative Fund will be renamed our ‘Generate KiwiSaver Moderate Fund'. This is an important and significant change for all our Conservative Fund members – any units currently held in Conservative fund will become units in the Generate KiwiSaver Moderate Fund. If you are currently a member of the Conservative fund, you will become a member in our Generate KiwiSaver Moderate Fund.

The 'Generate KiwiSaver Conservative Fund' that launches from 16 May 2022, will be a brand-new fund.

These new funds are not yet available:

We wanted to let you know that this new fund range is coming and that for the current Conservative Fund in particular, there will be important changes. No investment into these funds is currently being sought. The funds are not yet open, and no units can be purchased or acquired at this time. Once the funds are established, any offer to acquire units in the funds will be made in accordance with the Financial Markets Conduct Act 2013.

See what's changing from 16 May 2022:

Very important note for our Conservative Fund members:

When these funds launch, our current Conservative Fund will be renamed the Generate KiwiSaver Moderate Fund. If you currently hold units in this Fund, these units will become units in the Generate KiwiSaver Moderate Fund.

The risk profile for this fund has slightly more risk than our current Conservative Fund, as the target asset allocation to 'growth assets' will increase from 32.5% to 40%.

It's important that current Conservative members carefully consider their investment timeline and investment objectives, and make sure that the fund is right for their savings goals.

Members who intend on withdrawing their Generate KiwiSaver Scheme savings within the next 12 months (for example for a new home or retirement), should consider our new Generate KiwiSaver Defensive Fund or the new Generate KiwiSaver Conservative Fund, to help protect their investment from short-term market volatility.

For help choosing the right fund, take our KiwiSaver survey or seek financial advice.

Changes to our Stepping Stones investment options:

Our Stepping Stones options invest your Generate KiwiSaver Scheme savings based on your age. The investment strategies for these will also be changing from 16 May 2022 to become more growth-orientated.

While this increases the potential for higher long-term returns, it also increases the risk for these options.

What do our members need to do?

We’ll email all our members who are affected by these changes, with details on how the funds are changing. For members who are happy with these changes – there’s nothing they need to do. We will automatically manage the change on 16 May 2022.

However, if you would prefer to change your level of risk, you can choose to invest in another fund (or a combination of them).

All of these funds will be available in the Generate Online Account from 16 May 2022, where members can easily request a switch between funds.

For help choosing the right fund, take our KiwiSaver survey or seek financial advice.

A reminder for Conservative Fund members:

We encourage all Generate KiwiSaver Scheme members currently invested in the Conservative Fund, to review their investment strategy.

When these funds launch, units in the Conservative Fund will become units in the new Generate KiwiSaver Moderate Fund – this fund has a higher level of risk than the current Conservative Fund, as it holds more ‘growth assets’.

The newly created Generate KiwiSaver Conservative Fund will have a target asset allocation to growth assets of 20%. We are launching a new Generate KiwiSaver Defensive Fund, which should be a consideration for members who intend on withdrawing their KiwiSaver savings within the next 12 months. Remember, if you are currently in the Conservative Fund you will become a member in the Generate KiwiSaver Moderate Fund.

For help choosing the right fund, take our KiwiSaver survey or seek financial advice.

New Managed Funds:

We'll also be launching two new Managed Funds, to give our members additional non-KiwiSaver investment options.

Managed Funds work in a similar way to KiwiSaver, but you control how much and how often you want to invest and when you want to withdraw your investment.

We currently have a Focused Growth Managed Fund* and from 16 May 2022, we’ll also offer a Conservative Managed Fund and a Balanced Managed Fund.

Keep an eye out for more information on these new funds as we get closer to launch.

*Note this fund is currently called the Focused Growth Trust, however, we will be changing this to the Focused Growth Managed Fund.

FAQs:

Why are we making these changes?

These fund categories are widely used in the industry. We want to offer funds that are even better tailored towards our members specific objectives. The broader fund range means each fund has a narrower focus. This should be advantageous for the different stages of our members investment journey. To accommodate the new funds, we needed to change the existing target asset allocation of our existing funds.

Whilst the new Generate KiwiSaver Moderate Fund does increase the exposure to growth assets, its asset allocation is the closest to the existing Conservative fund. The new Generate KiwiSaver Defensive Fund, and the new Generate KiwiSaver Conservative Fund offer a more conservative approach than our current fund range offering, which may be suitable for some members depending on their specific needs. We strongly encourage all our members to consider which of the new funds best meets their particular investment objectives and seek financial advice if required.

The introduction of the new funds is something that we have been working on for a while. It is not driven by any market event, or any change to our investment approach at Generate. It creates a wider selection of funds which we think will create an even better product offering for our members.

If you have any questions about these changes, feel free to contact one of our friendly advisers on info@generatekiwisaver.co.nz

I don’t want to stay in the Moderate Fund when the changes are made, what can I do?

The best thing to do if you believe the changes might not suit you is to speak to your adviser or, when the new funds go live, you can use the Risk Profile tool to check which fund is best suited to your needs.

We are unable to make any changes until after 16 May and there will be no changes to your current fund until then. After 16 May if you would like to make a change the easiest way to do this is to log into your account and request to transfer to the fund of your choice.

How do I move to one of the new funds?

After 16 May if you would like to make a change the easiest way to do this is to log into your account and request to change.

These new funds are not yet available:

No investment into these funds is currently being sought. The funds are not yet open, and no units can be purchased or acquired at this time. Once the funds are established, any offer to acquire units in the funds will be made in accordance with the Financial Markets Conduct Act 2013.

We won’t be able to take requests to transfer until the mandatory regulatory disclosure documentation, the product disclosure statement is available. We will not be able to distribute the product disclosure statement until 16 May.

What are the performance/returns on the new funds? Defensive, Conservative and Balanced?

Unfortunately, as the funds don’t yet exist, we do not have any fund specific performance available. We are able to tell you the Morningstar average return over the past 10 years for the Conservative Funds was 5.8% after fees and for Moderate Funds was 6.6%. There is no direct fund type comparison for our defensive fund and because it is a very low risk fund you should assume a low rate of return.

Why are you changing the Conservative Fund?

We want to offer Generate KiwiSaver Scheme Funds that are even better tailored towards our members specific objectives. The broader fund range means each fund can have a narrower focus. This has resulted in adding 3 new funds (Defensive, Conservative and Balanced) to our existing Generate KiwiSaver fund range. To accommodate our broader fund range we needed to change the existing target asset allocation of the existing funds.

We will now have 3 funds at the more conservative end of the risk spectrum:

- A new Defensive Fund, which will be targeted 100% to income assets.

- Our new Conservative Fund, a target asset allocation of 20% exposure to growth assets, 80% to income assets

- Our Moderate Fund with a target asset allocation of 40% exposure to growth assets, 60% to income assets (the current Conservative Fund)

As part of this change the existing Conservative Fund will be renamed ‘Moderate Fund’ and increase its exposure to growth assets from up to 32.5% to up to 40%. The new Moderate Fund's allocation is closest to the existing Conservative Fund, but we strongly encourage all members to consider which of the funds best meets their particular investment objectives, (e.g. like saving for a first home withdrawal).

Why are you making these changes?

These fund categories are widely used in the industry, and we wanted to have funds in each of the categories. We want to offer Generate KiwiSaver Scheme Funds that are even better tailored towards our members specific objectives. The broader fund range means each fund has a narrower focus. This should be advantageous for the different stages of our members investment journey. To accommodate the new funds, we needed to change the existing target asset allocation of our existing funds.

Why are you interrupting my investment during a time of heavy market volatility?

The introduction of the new funds is something that we have been working on for a while. It is not driven by any market event, or any change to our investment approach at Generate. It creates a wider selection of funds which we think will create an even better product offering for our members.

We believe strongly in investing in the right fund for your risk appetite and then staying the course through market up and downs – that has not changed.

While you stay the course and invest in your fund of choice, we have a specialist investment committee actively managing your investment through all market conditions, including the volatility we have been experiencing recently. They are charged with making decisions around buying and selling assets and they will implement any changes to the underlying investments of your fund.

Is tax payable also going to be triggered at the time of switch?

In KiwiSaver your tax on your fund is generally calculated daily and accrued into the daily fund price, it is then paid at the end of the tax year. However if you change funds during the year the tax is paid at the time of your move. This is industry standard and would be the same if you moved between our existing funds currently.

Can I get financial advice on the new fund range prior to 16 May?

We cannot provide financial advice on the new funds prior to 16 May. However, we can talk to you about the fund characteristics, their objective and when they’re generally going to be suitable.